- English

- Deutsch

Simplify filing with ECM tag-based software

Replace your cumbersome folder hierarchies with our simple-to-use software that adds tags to your documents (images, scans, and videos included!) and automates filing.

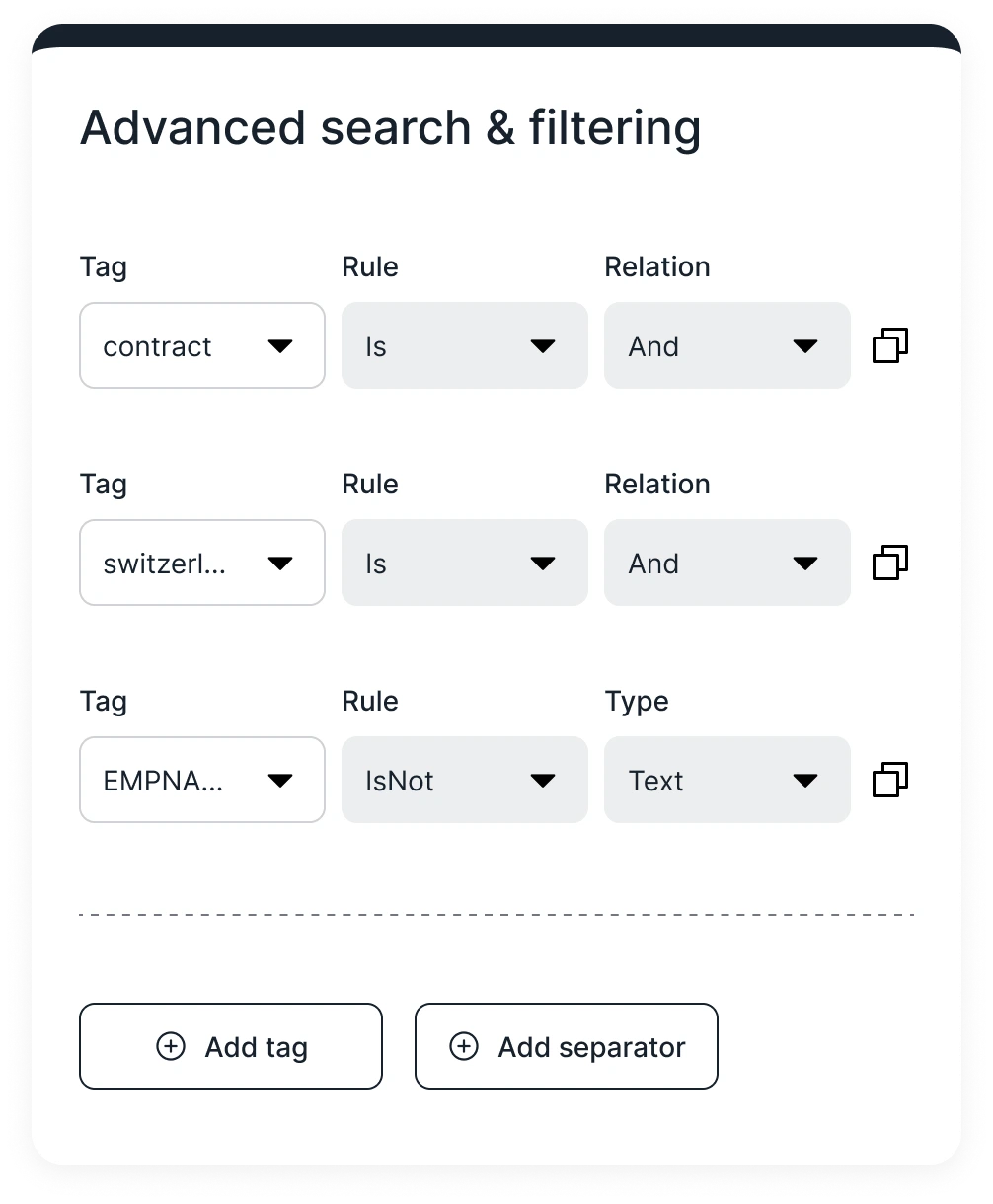

When all files go to the same spot, you can't misplace them. Looking for a subcontractor estimate from an old project? An instant search with a few tags, and voilà!

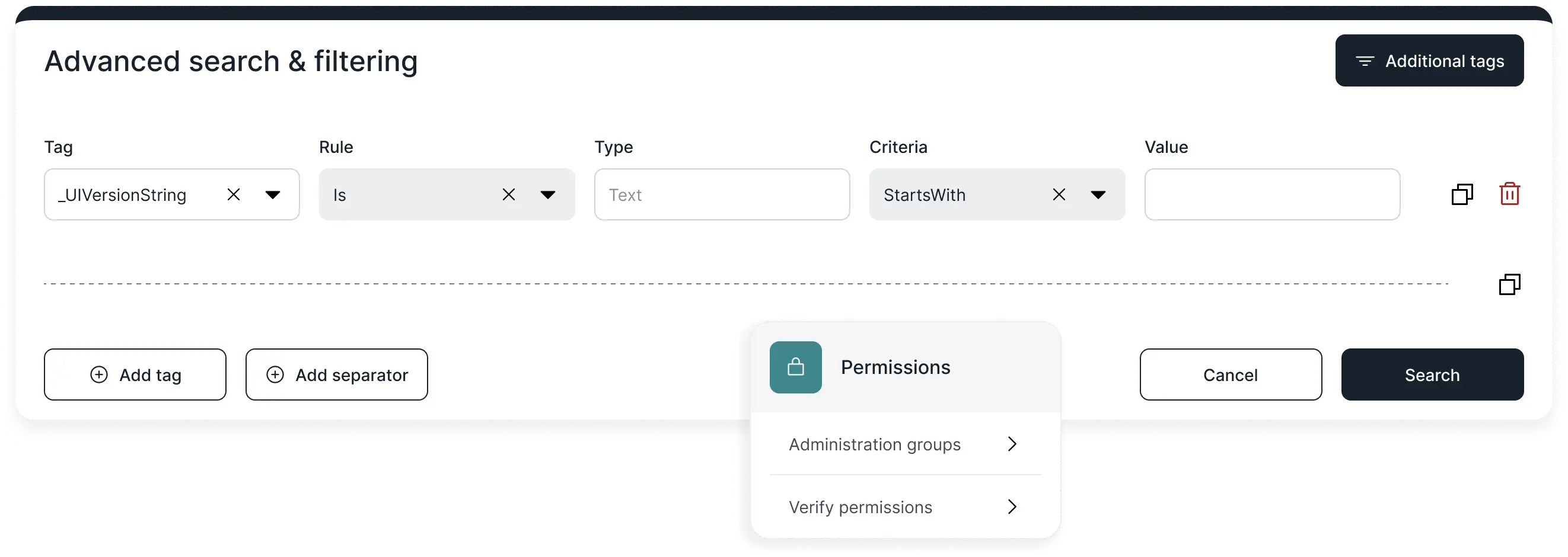

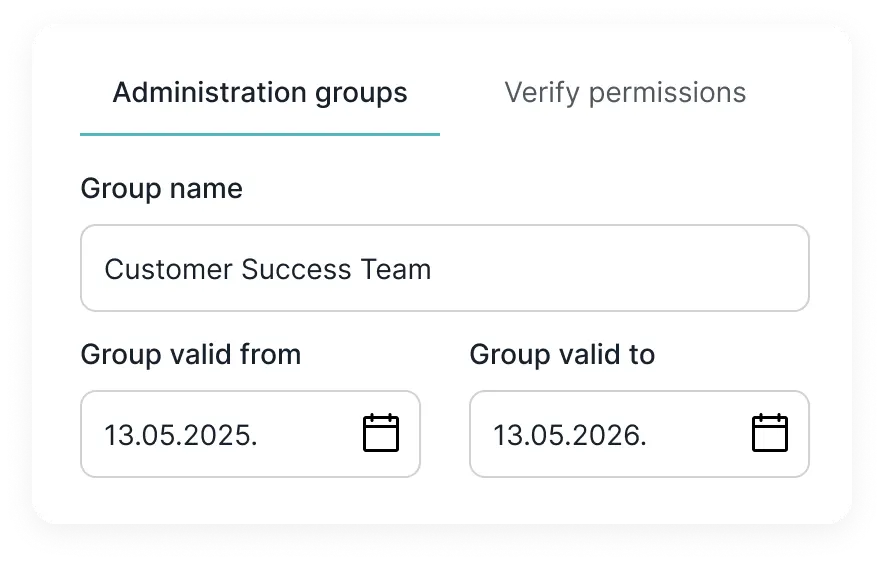

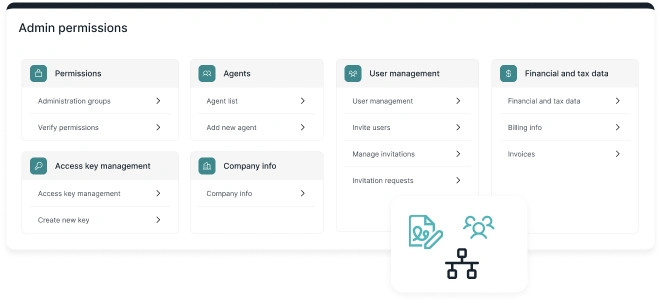

Avoid siloing information and parallel filing systems within your organization. KORTO can ensure the required access according to user roles, lines of business, and function.

Ensure compliance with automated employee record disposal triggered by the termination date.

Optimize storage with automated invoice destruction after the retention period ends.

Use agreement end dates to trigger reviews of supplier compliance forms.

Retain critical case files by requiring your team to approve destruction or extend retention.

Maximize data protection and set triggers to delete anything, from job applications to client info.

Connect your file share and email systems such as MS Sharepoint and Exchange so that KORTO can automate file 'pulling'. You can also add files manually.

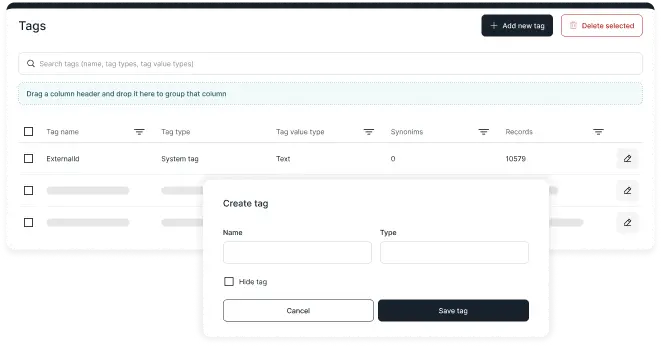

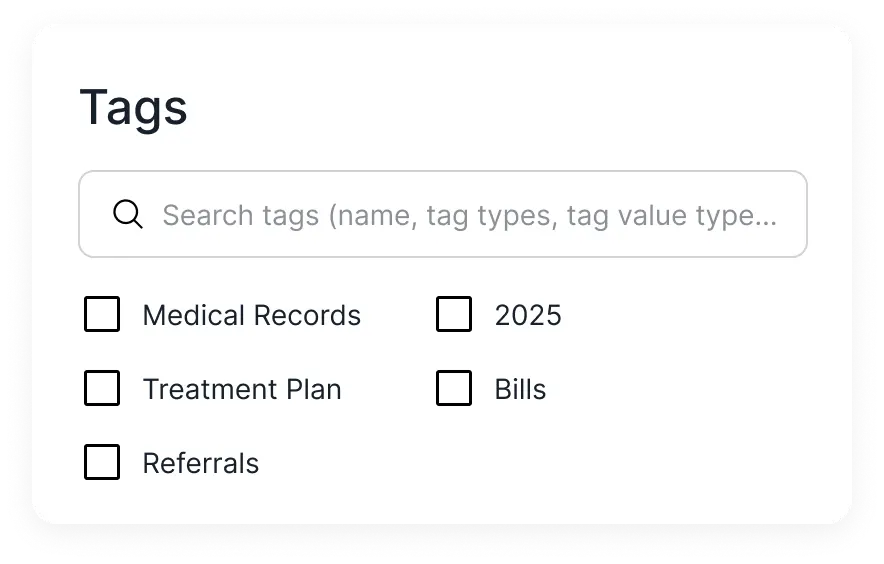

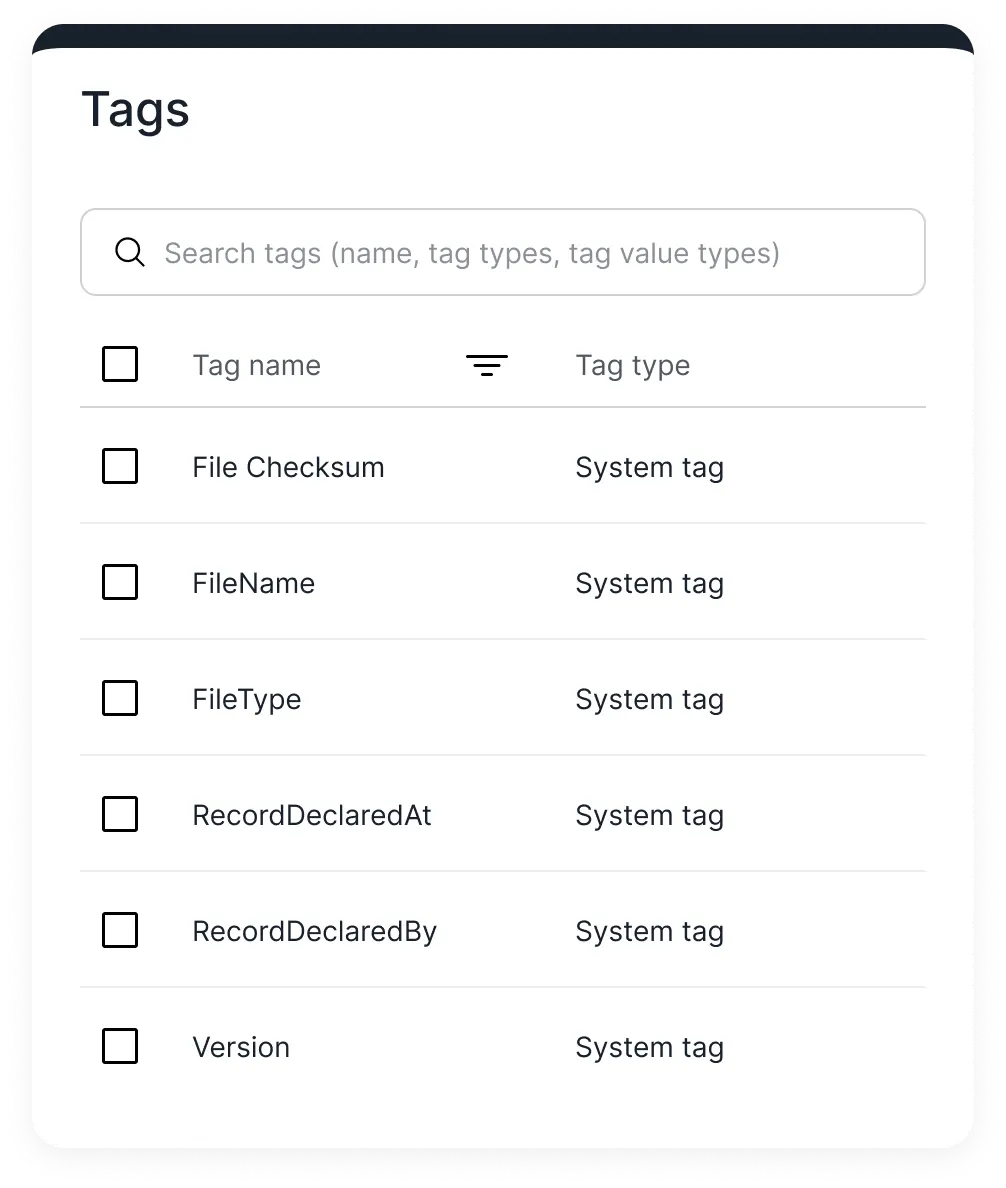

KORTO adds system tags which you can enhance with manually added labels and tags. Boost KORTO with integrations for AI-powered automated tagging.

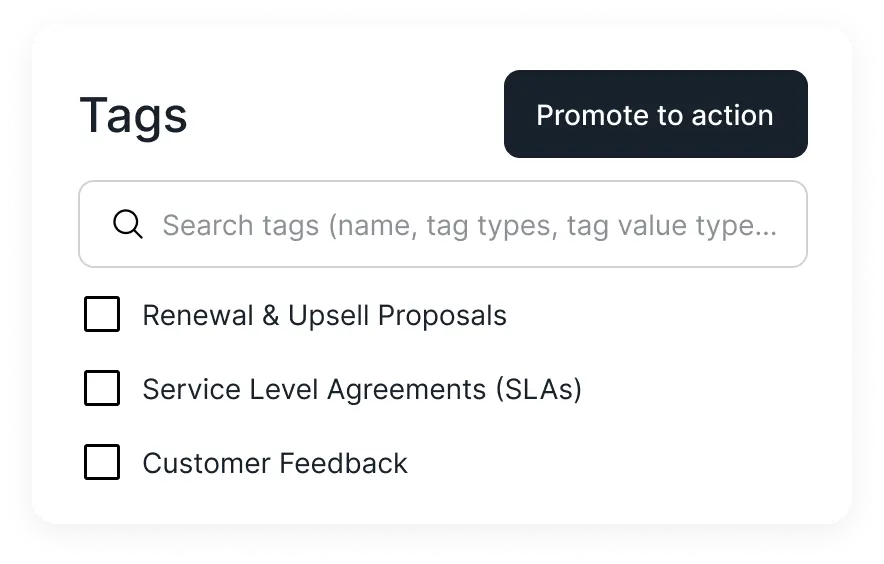

Set retention procedures in motion by adding action tags. Fully automated workflows, that track the entire lifecycle of your records, are available with integrations.

Leverage activity logs, granular access management, electronic signatures, time stamps, and the optional blockchain integration to ensure compliance and tamper-proof security.

Orchestrate KORTO and its integrations for game-changing automation of your Enterprise Content Management processes over the entire lifecycle of your files.

Flexible enough to meet every team's needs

Create workflows to chart the entire lifecycle of your records in line with your data retention policies across all your geographies.

Read moreElectronic signatures and time stamps combine with KORTO's audit logs and blockchain integration for tamper-proof records.

Read moreKeep your records safe with KORTO, powered by secure cloud systems and APIs, granular access control, and blockchain technology.

Read moreOr even understand themselves — revealing knowledge that’s been hidden in your systems all along?

Read more about What if your documents could talk — instead of just sitting in folders?Switch your business content to autopilot with Cloud-based Enterprise Content Management System.

Read more about What is an enterprise content management system (ECM)?Begin your research on successfully implementing ECM here.

Read more about How to Implement an ECM Platform?