Data Retention Requirements by Industry

Table of Contents

Storing company documents securely is crucial for protecting data and meeting legal requirements. Important documents like personnel files and tax records must be kept according to regulations to prevent future issues.

Let's dive into data retention periods in individual industries.

Healthcare: HIPAA Guidelines for Patient Data Retention

HIPAA, Health Insurance Portability and Accountability Act, is designed to protect the privacy of an individual's health information and ensure the secure exchange of health information among covered entities and their business associates. This is important for anyone handling sensitive health information in the healthcare system.

There are a couple of reasons what are HIPAA’s data retention guidelines are essential for healthcare organizations:

- managing patient data properly,

- ensuring compliance and

- safeguarding privacy.

HIPAA doesn’t set specific retention periods for medical records. However, it requires that sensitive patient data must be kept for at least six years.

In order to avoid costly fines and reputational damage, healthcare organisations have to adhere to HIPAA’s retention rules. Organizations have to retain documents like patient consent forms, security assessments, and incident reports.

This helps them demonstrate that they care about data privacy and security, especially during audits or lawsuits. In addition to being important for regulatory compliance, proper data retention helps with better organization and protects patient privacy.

HIPAA applies to various organizations handling Protected Health Information (PHI), including healthcare providers, telemedicine providers, health insurers, and healthcare clearinghouses. These entities, along with their Business Associates (such as billing providers and IT services), must comply with HIPAA retention rules and state-specific regulations.

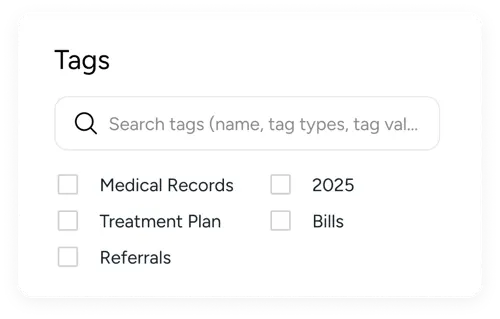

HIPAA covers a range of data types for retention, including medical records, billing records, PHI risk analyses, security policies, audit logs, and documentation related to security breaches and incidents. Each organization must securely store and eventually dispose of this data following the appropriate retention periods to ensure compliance.

For a more streamlined way to handle this, consider using tools like KORTO to automate the data management process and stay compliant with regulations.

How can KORTO help?

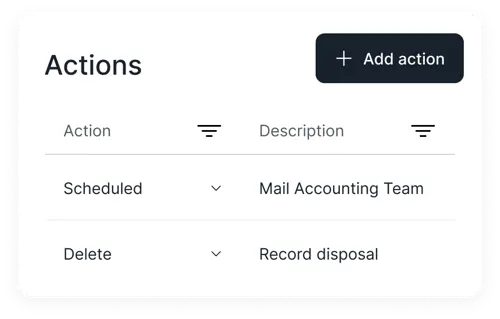

KORTO.io automates the management of sensitive healthcare data, ensuring that medical records, patient consent forms, and security reports are stored securely for at least six years, as required by HIPAA. The platform automatically categorizes documents by type and retention period, and sends alerts for timely archival or deletion to maintain compliance.

Let's see an example:

Imagine a clinic using KORTO.io to track all patient documents. After six years from the last treatment date, KORTO generates a report highlighting records eligible for secure deletion, helping the clinic avoid costly fines for retaining data longer than necessary.

Find our more on how can KORTO streamline clinic's operations.

Finance and Banking

When determining the retention periods for tax and financial documents for entrepreneurs, we can say that the most important regulations are:

- Accounting Act

- General Tax Act

- Regulations on Accounting

Retention periods for accounting documents:

- Documents on the basis of which data were entered into the journal and general ledger, and subsidiary books, are kept for at least 11 years.

- Payrolls, analytical records of salaries for which mandatory contributions are paid are kept permanently.

A taxpayer may decide to store documentation outside the borders of the Republic of Croatia. This rule applies only if the country in which he wants to store the documentation is a member of the European Union. Regardless of where the taxpayer stores the documentation, he is responsible for it at all times, and is obliged to make it available to the competent supervisory authorities at all times, upon their request.

Without documentation, it would not be possible to subsequently verify the veracity of business events and their tax impact. For this reason, every taxpayer is obliged to keep business documentation that is generated in the course of business operations within the deadlines prescribed by accounting, tax, customs, foreign exchange, and other regulations, so the question often arises as to what are the deadlines for keeping individual business documentation.

An entrepreneur may also store business documentation in electronic form. An entrepreneur who stores business books using electronic devices that guarantee online access to data must, upon request, provide the supervisory authority with the right to access, download and use these business books.

After the deadline for storing documentation has expired, taxpayers may not destroy the documentation on their own, and everything is defined in the Act on Archival Materials and Archives, so this must be taken into account before you decide to destroy the documentation and study the aforementioned Act.

How can KORTO help?

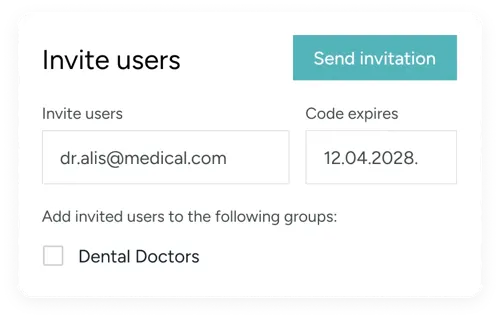

KORTO.io assists financial institutions and entrepreneurs in tracking retention periods for accounting and tax documents. It automates the classification, storage, and retrieval of financial records, ensuring compliance with the Accounting Act, General Tax Act, and other regulations. This makes audits and tax inspections more efficient and less stressful.

Scenario:

An entrepreneur uses KORTO.io to automatically archive payrolls and accounting books while receiving notifications about upcoming deadlines for document retention. When tax inspectors request access, the entrepreneur can quickly provide the required documents through the system, ensuring transparency and compliance.

Find out more on how can KORTO help financial institutions.

Legal and Law Enforcement: Data Retention for Cases and Evidence

Different regulations prescribe different retention periods for individual documents. If this is the case, the documents should be kept for the longest prescribed period. For documents whose period of data retention is not prescribed by law, the entrepreneur should determine the retention period himself by internal act.

In the legal and law enforcement sectors, data retention is critical for case management and evidence preservation. Criminal evidence, case files, and investigation records must be retained for several years or even indefinitely in some cases.

Business books (journal and general ledger, and subsidiary books) are kept for at least 11 years. The retention period for business books begins on the last day of the business year to which they relate. Financial statements, annual reports, and audit reports (if the business is subject to audit obligations) are kept permanently in their original form.

Keeping track of this can be tough without the right systems in place, so it’s important to have best practice methods for managing data retention across cases.

How can KORTO help?

KORTO.io helps legal firms and law enforcement agencies securely store case files, evidence, and investigation records according to legal retention periods. It supports long-term archival and controlled access, with customizable retention policies based on internal rules when no legal timeframe exists.

Scenario:

A law firm managing sensitive case files uses KORTO.io to automate the retention of evidence and case documents for the legally required periods. The system prevents premature deletion and facilitates secure, quick retrieval of files during trials or audits.

Retail and E-commerce

Customer data retention is necessary for customer service, order fulfillment, and compliance with tax regulations. Transaction records and personal information must generally be kept for a minimum of five years.

However, businesses also need to comply with data protection regulations like GDPR, which limit how long personal data can be stored unless there’s a clear and justifiable reason. Proper data retention helps in handling customer inquiries, returns, and protecting consumer rights.

How can KORTO help?

KORTO.io streamlines customer data management by automating retention schedules for transaction records and personal data, ensuring compliance with tax regulations and GDPR. It balances the need to retain data for business purposes while safeguarding customer privacy.

Scenario:

An online store uses KORTO.io to keep customer order and transaction data for the required five years, while automatically flagging and deleting personal information that is no longer needed or legally allowed to be stored, thus maintaining GDPR compliance.

Manage every request with clarity - from orders to complaints with KORTO.

The Role of Data Retention in Protecting Customer Privacy

Data retention is crucial for businesses across all sectors, from healthcare to finance, legal, and retail.

Understanding industry-specific retention requirements ensures compliance, security, and efficient data management.

Automating the process with tools like KORTO helps meet regulations and boost efficiency. By following best practices, and a policy example, businesses can protect data, stay compliant, and build trust with clients.

5-Second Summary

Effective data retention is crucial for businesses across industries to ensure compliance, security, and operational efficiency. Industry-specific regulations, like HIPAA for healthcare and GDPR for retail, dictate how long data should be stored. Tools like KORTO help automate the process, ensuring proper data management and protection.